FAQ

Post-Registration Activites

- Post-Registration Actions

- Corporate Matters

- Contractual Matters

- Rules and Regulations

- Fees and Invoices

- Legal Address

- Tax Matters

Open a bank account. You need to provide notarized translation of the Articles of Association.

AIFC Participants must notify the Registrar regarding the changes in registered details. Follow the Guidance on Filing Obligations of AIFC Participants to the Registrar of Companies.

AIFC participants may open a bank account in any bank. The requirements are defined by the selected bank.

EDS can be obtained online at https://egov.kz/cms/en/services/pass_onlineecp or by visiting a community service centre (ЦОН) near you.

AIFC Participants must notify only the Registrar by filing the applications. Changes in DoJ are handled by the Office of the Registrar.

AIFC Participants are obliged to complete a specified number of filings to the Registrar of Companies on an annual basis depending on the level of turnover. The following are the ongoing filing obligations:

• Filing of annual accounts

• Filing of annual return

• Filing of annual confirmation statement

Follow the Guidance on Filing Obligations of AIFC Participants to the Registrar of Companies.

No, all supporting documents must be in English language or accompanied by an appropriate translation certified to the satisfaction of the Registrar of Companies.

Constitutional Statute of the RoK on the AIFC, Article 15.Language of the AIFC.

Please find the list of Ancillary Service Providers (with their contacts) on the https://digitalresident.kz – Ancillary Service Providers.

Yes, in this case, the participant sends all necessary documents at the same time, and the total price of all procedures will be 50 USD.

No, the original versions must be provided to the Office of the Registrar. (Because of the coronavirus pandemic the Office of the Registrar accept scan copies by now)

An administrative inquiry includes the:

1) Request for extract of shareholders’ registry

2) Request for extract of directors’ registry

3) Request for extract of Ultimate Beneficial Owners registry

4) Request for extract from Public Register

Approximately 5 business days. For more information on the process of making post-registration application, refer to Guidance on Post-registration applications to the Office of the Registrar of Companies (https://afsa.aifc.kz/post-registration/ (Afsa.aifc.kz – registration – post registration)

Director/CEO or authorised signatory.

Chief Executive Officer must be a natural person who has an Individual Identification Number (IIN).

AIFC Participants have to send share pledge agreement to the Security Registrar ([email protected]) and make payment of fees in accordance with AIFC Security Rules (Schedule 1)

No, AFSA does not monitor the participant’s contract. It is only required to register Share Pledge Agreement.

No, the Contracts with third parties (clients, suppliers, partners) can be concluded in any language, but they must be provided in English or certified and translated into English in case of litigation in AIFC Court.

No, the employee contracts are operational documents and mustn’t be registered in AFSA. It is recommended to register employee contracts in The Single Accounting System for Employment Agreements (ЕСУТД). Employee Contracts are drawn up in accordance with AIFC Employment Rules for all AIFC Participants. All other Civil Contracts must be compiled in accordance with AIFC Contract Regulations.

No, all supporting documents must be in the English language or accompanied by an appropriate translation certified to the satisfaction of the Registrar of Companies.

Constitutional Statute of the RoK on the AIFC, Article 15.Language of the AIFC.

You need to contact [email protected].

No, participants must receive information about changes to the AIFC Rules and Regulations by themselves on the website: afsa.aifc.kz (legal framework – public consultations – Afsa)

Website: afsa.aifc.kz (legal framework – public consultations – Afsa)

No. If AIFC Participant is engaged in regulated activities, it must contact its Relationship Manager (or send an email to [email protected]) for making necessary arrangements in relation to the Post-registration application and obtaining the required approval (if necessary).

An AIFC Participant may request an Extract of information from AFSA, who in turn will issue a certificate upon payment of 20 USD for the procedure.

Yes, other legal entities may pay the invoice for a participant, in this case, there must be indicated BIN (or bank requisites for non-residents) of the payer in the request for an invoice for the post-registration procedure.

50USD

Yes. A participant must pay an appropriate fee regardless of whether MoJ is notified. All prescribed fees payable to AFSA are set out in AIFC Fees Rules, where post-registration fees are listed in Schedule 5-1.

An administrative inquiry fee is 20 USD.

Yes. If a natural person is a resident of RoK, then IIN and a copy of ID (both sides) must be provided. If a natural person is a non-resident of RoK, then a passport copy must be provided.

Yes. If a body corporate is a resident of RoK (AIFC Participants are residents of RK), then BIN must be provided. If a body corporate is a non-resident of RoK, then bank requisites must be provided.

If a payer (natural person/body corporate) is a resident of RK (AIFC Participants are residents of RK), then the invoice must be paid in KZT only, non-Resident can pay in USD.

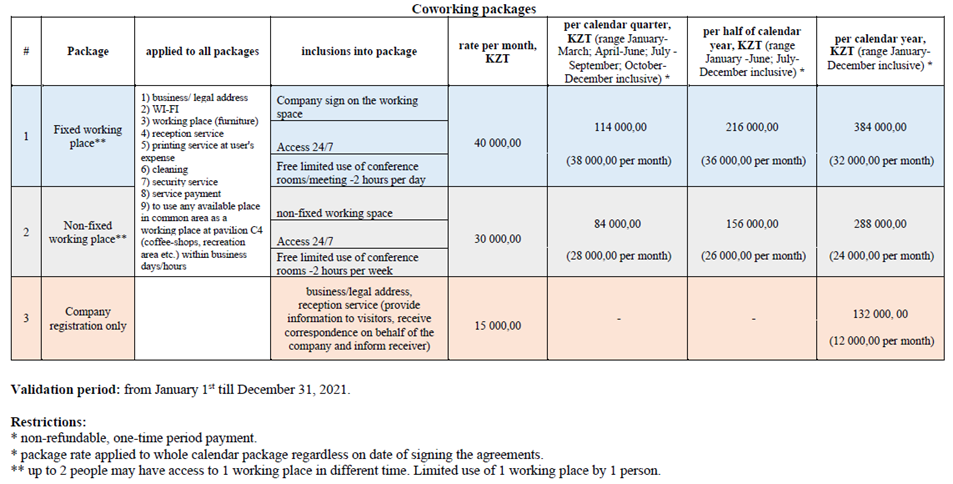

The concept of a coworking zone has been established as a response to market demand and helps to overcome the operational challenges of our valuable participants. AIFC offers a coworking zone as a legal address.

Upon registration process (once a company obtains BIN), a company has to sign a sublease agreement, which is put in place for contract terms and conditions between the “Lessor” (AIFC Authority JSC) and the “Party” (a prospect). A process of obtaining a legal address is issued in turn, as follows:

- A company completes a form for allocation at a coworking zone and sends it along with a certificate of incorporation to us, the ABC Participant Support Department;

- ABC Participant Support Department signs it and passes it over to AIFC Property Department;

- AIFC Property Department sends a commercial proposal to a representative of a company;

- AIFC Property Department sends a signed and approved sublease agreement to a company;

- Once both sides sign a sublease agreement, a company keeps one copy for their own relevant purposes.

It is the sole responsibility of a company to have a registered office within the AIFC territory upon the expiration of a sublease agreement.

AIFC Companies Regulations, Section 24. Registered office.

A legal address is valid for the duration of a sublease agreement and a company shall be solely responsible for allocation within the AIFC territory upon expiration of a sublease agreement and a legal address.

AIFC Companies Regulations, Section 24(1). Registered Address

Yes. If a company changes its office location, then it must undergo a post-registration procedure: change of registered address. A company may change the address of its registered office by giving notice to the Registrar. The change takes effect upon the notice being registered by the Registrar. There is an associated fee of 50 USD.

AIFC Companies Regulations, Section 24 (3-1).Registered office.

Fees Rules, Schedule 5-1: Administrative service fees payable to the Registrar of companies.

7000 tg for 1 sq.m.

You may contact AIFC Property ([email protected]) to make a sight inspection of coworking zones and offices.

AIFC Participants must file tax reports in accordance with Article 6 of the Constitutional law of the Republic of Kazakhstan on AIFC. Tax reports must be submitted to the Department of State Revenue of Essil district.

Using an electronic digital signature (ЭЦП) you can enter to Taxpayer’s webroom at https://kgd.gov.kz/

The concept of coworking does not require a full-time presence of a company and therefore passing tax inspection, which is also convenient for VAT payers. The Tax Code RoK, Article 558: Tax Inspection, subparagraph 4, in the event of a tax inspection resulting in the actual absence of taxpayers (tax agents) in places of their location specified in the registration details, the Tax Service Authority shall forward to such taxpayer a notice for the confirmation of the location of the taxpayer (tax agent).