FAQ

Registration FAQ

- Group 1

- Corporate Matters

- Contractual Matters

- Rules and Regulations

- Fees and Invoices

- Legal Address

- Tax Matters

Answer1.

AIFC Participants must notify the Registrar regarding the changes in registered details. Follow the Guidance on Filing Obligations of AIFC Participants to the Registrar of Companies.

AIFC participants may open a bank account in any bank. The requirements are defined by the selected bank.

EDS can be obtained online at https://egov.kz/cms/en/services/pass_onlineecp or by visiting a community service centre (ЦОН) near you.

AIFC Participants must notify only the Registrar by filing the applications. Changes in DoJ are handled by the Office of the Registrar.

AIFC Participants are obliged to complete a specified number of filings to the Registrar of Companies on an annual basis depending on the level of turnover. The following are the ongoing filing obligations:

• Filing of annual accounts

• Filing of annual return

• Filing of annual confirmation statement

Follow the Guidance on Filing Obligations of AIFC Participants to the Registrar of Companies.

No, all supporting documents must be in English language or accompanied by an appropriate translation certified to the satisfaction of the Registrar of Companies.

Constitutional Statute of the RoK on the AIFC, Article 15.Language of the AIFC.

Please find the list of Ancillary Service Providers (with their contacts) on the https://digitalresident.kz – Ancillary Service Providers.

Yes, in this case, the participant sends all necessary documents at the same time, and the total price of all procedures will be 50 USD.

No, the original versions must be provided to the Office of the Registrar. (Because of the coronavirus pandemic the Office of the Registrar accept scan copies by now)

An administrative inquiry includes the:

1) Request for extract of shareholders’ registry

2) Request for extract of directors’ registry

3) Request for extract of Ultimate Beneficial Owners registry

4) Request for extract from Public Register

Approximately 5 business days. For more information on the process of making post-registration application, refer to Guidance on Post-registration applications to the Office of the Registrar of Companies (https://afsa.aifc.kz/post-registration/ (Afsa.aifc.kz – registration – post registration)

Director/CEO or authorised signatory.

Chief Executive Officer must be a natural person who has an Individual Identification Number (IIN).

AIFC Participants have to send share pledge agreement to the Security Registrar ([email protected]) and make payment of fees in accordance with AIFC Security Rules (Schedule 1)

No, AFSA does not monitor the participant’s contract. It is only required to register Share Pledge Agreement.

No, the Contracts with third parties (clients, suppliers, partners) can be concluded in any language, but they must be provided in English or certified and translated into English in case of litigation in AIFC Court.

No, the employee contracts are operational documents and mustn’t be registered in AFSA. It is recommended to register employee contracts in The Single Accounting System for Employment Agreements (ЕСУТД). Employee Contracts are drawn up in accordance with AIFC Employment Rules for all AIFC Participants. All other Civil Contracts must be compiled in accordance with AIFC Contract Regulations.

No, all supporting documents must be in the English language or accompanied by an appropriate translation certified to the satisfaction of the Registrar of Companies.

Constitutional Statute of the RoK on the AIFC, Article 15.Language of the AIFC.

You need to contact [email protected].

No, participants must receive information about changes to the AIFC Rules and Regulations by themselves on the website: afsa.aifc.kz (legal framework – public consultations – Afsa)

Website: afsa.aifc.kz (legal framework – public consultations – Afsa)

No. If AIFC Participant is engaged in regulated activities, it must contact its Relationship Manager (or send an email to [email protected]) for making necessary arrangements in relation to the Post-registration application and obtaining the required approval (if necessary).

An AIFC Participant may request an Extract of information from AFSA, who in turn will issue a certificate upon payment of 20 USD for the procedure.

Yes, other legal entities may pay the invoice for a participant, in this case, there must be indicated BIN (or bank requisites for non-residents) of the payer in the request for an invoice for the post-registration procedure.

50USD

Yes. A participant must pay an appropriate fee regardless of whether MoJ is notified. All prescribed fees payable to AFSA are set out in AIFC Fees Rules, where post-registration fees are listed in Schedule 5-1.

An administrative inquiry fee is 20 USD.

Yes. If a natural person is a resident of RoK, then IIN and a copy of ID (both sides) must be provided. If a natural person is a non-resident of RoK, then a passport copy must be provided.

Yes. If a body corporate is a resident of RoK (AIFC Participants are residents of RK), then BIN must be provided. If a body corporate is a non-resident of RoK, then bank requisites must be provided.

If a payer (natural person/body corporate) is a resident of RK (AIFC Participants are residents of RK), then the invoice must be paid in KZT only, non-Resident can pay in USD.

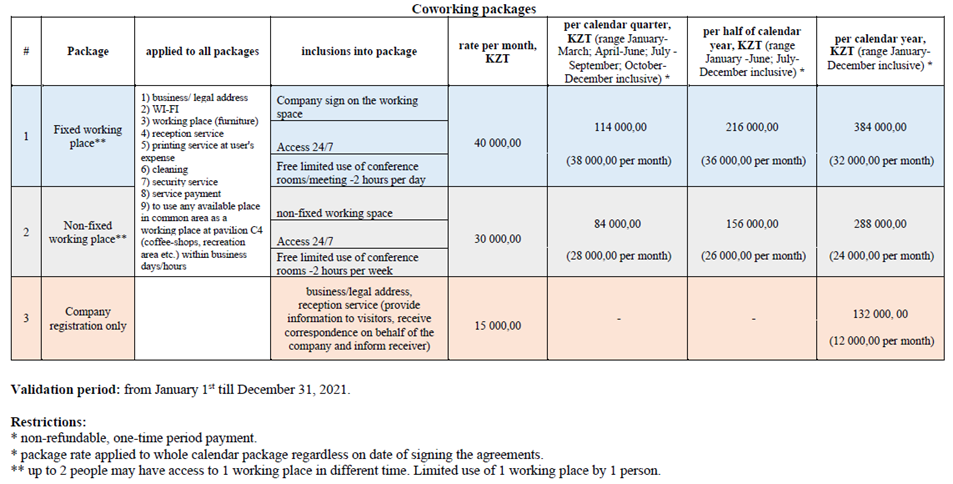

The concept of a coworking zone has been established as a response to market demand and helps to overcome the operational challenges of our valuable participants. AIFC offers a coworking zone as a legal address.

Upon registration process (once a company obtains BIN), a company has to sign a sublease agreement, which is put in place for contract terms and conditions between the “Lessor” (AIFC Authority JSC) and the “Party” (a prospect). A process of obtaining a legal address is issued in turn, as follows:

- A company completes a form for allocation at a coworking zone and sends it along with a certificate of incorporation to us, the ABC Participant Support Department;

- ABC Participant Support Department signs it and passes it over to AIFC Property Department;

- AIFC Property Department sends a commercial proposal to a representative of a company;

- AIFC Property Department sends a signed and approved sublease agreement to a company;

- Once both sides sign a sublease agreement, a company keeps one copy for their own relevant purposes.

It is the sole responsibility of a company to have a registered office within the AIFC territory upon the expiration of a sublease agreement.

AIFC Companies Regulations, Section 24. Registered office.

A legal address is valid for the duration of a sublease agreement and a company shall be solely responsible for allocation within the AIFC territory upon expiration of a sublease agreement and a legal address.

AIFC Companies Regulations, Section 24(1). Registered Address

Yes. If a company changes its office location, then it must undergo a post-registration procedure: change of registered address. A company may change the address of its registered office by giving notice to the Registrar. The change takes effect upon the notice being registered by the Registrar. There is an associated fee of 50 USD.

AIFC Companies Regulations, Section 24 (3-1).Registered office.

Fees Rules, Schedule 5-1: Administrative service fees payable to the Registrar of companies.

7000 tg for 1 sq.m.

You may contact AIFC Property ([email protected]) to make a sight inspection of coworking zones and offices.

AIFC Participants must file tax reports in accordance with Article 6 of the Constitutional law of the Republic of Kazakhstan on AIFC. Tax reports must be submitted to the Department of State Revenue of Essil district.

Using an electronic digital signature (ЭЦП) you can enter to Taxpayer’s webroom at https://kgd.gov.kz/

The concept of coworking does not require a full-time presence of a company and therefore passing tax inspection, which is also convenient for VAT payers. The Tax Code RoK, Article 558: Tax Inspection, subparagraph 4, in the event of a tax inspection resulting in the actual absence of taxpayers (tax agents) in places of their location specified in the registration details, the Tax Service Authority shall forward to such taxpayer a notice for the confirmation of the location of the taxpayer (tax agent).

All application forms should be filled in by the applicant, but AIFC team can assist you. Another option is to apply to the ASP companies which can help you with filling application forms.

No, starting from September, 2020 registration can be done only through the self- service portal www.digitaresident.kz.

No, you can use only KZT or USD.

By default, Authorised person is appointed only for the purpose of registration of the company. Rights and obligations of Authorised person reflected in Resolution.

Yes, please download it from the website

ANTI-MONEY LAUNDERING/COUNTERING TERRORIST FINANCING POLICIES AND PROCEDURES are internal documents that should be developed by the company/applicant itself. In order to comply with Rules AIFC has developed Anti-Laundering Money Guide and GUIDELINES FOR ANTI-MONEY LAUNDERING/COUNTERING TERRORIST FINANCING POLICIES AND PROCEDURES which can be obtained from https://afsa.aifc.kz/guides/, https://afsa.aifc.kz/files/legals/321/file/aml-guidance-eng.pdf

Depositing money is considered as responsibility of Shareholders of Private companies, AFSA does not check or control such issue. But when it comes to postregistration procedures such as liquidation there could be problems if Share capital is not paid up.

There is no strict obligation to have share capital for NPIO.

No, share capital of a Branch/Recognised company does not need to be established.

Ultimate Beneficial Owner is natural person who owns or controls (directly or indirectly) Shares in the share capital of the company or other Ownership Interests in the Relevant Person of at least 25%; owns or controls (directly or indirectly) voting rights in the Relevant Person of at least 25%; owns or controls (directly or indirectly) the right to appoint or remove the majority of the Directors of the Relevant Person; or has the legal right or through other ownership interests to exercise, or actually exercises, significant control or influence over the activities of the company.

Name of a company should be proper and not misleading, be advised that name of a company should be followed by “Limited” or “Ltd.” in case if Private company and Public Limited Company’ or the abbreviation ‘PLC’ or ‘plc’. Name of the General Partnership must end with the word ‘Partnership’ or ‘and Partners’ or ‘& Co.’ Name of the Limited Partnership must end with the words ‘Limited Partnership’ or the abbreviation ‘LP’. Name of the Limited Liability Partnership must end with the words ‘Limited Liability Partnership’ or the abbreviation ‘LLP’.

The following provisions apply to the name of a Company or the reservation of a name for a Company (or a proposed Company):

(a) the name must use letters of the English alphabet, numerals or other characters acceptable to the Registrar of Companies;

(b) the name must not, in the opinion of the Registrar, be, or be reasonably likely to become, misleading, deceptive or conflicting with another name (including an existing name of another Company or Recognised Company);

(c) the name must not inclue words that may suggest a relationship with the AIFCA, AFSA or any other governmental authority in the AIFC, Nur-Sultan or the Republic of Kazakhstan, unless the relevant authority has consented in Writing to the use of the name;

(d) the name must not include any of the following words unless the AFSA has consented in Writing to their use:

(i) the word ‘bank’, ‘insurance’ or ‘trust’;

(ii) words that suggest that the Company (or proposed Company) is a bank, insurance company or trust company;

(iii) words that suggest in some other way that it is authorised to conduct Financial Services in the AIFC;

(e) the name must not include words that may suggest a connection with, or the patronage of, any Person or organisation, unless the Person or organisation has consented in Writing;

(f) the name must not be, in the opinion of the Registrar, otherwise undesirable.

Yes, one person can be a Director, CEO and Authorised person as well. Director and CEO have duties and rights to manage company after registration, Authorised person is responsible for any communication with AFSA. CEO is appointed for the purpose of interacting with State bodies, banks and etc., whereas Director is the person who should be responsible for interacting with AIFC.

Secretary of the Company is responsible for ensuring that Company’s corporate administration obligations under the AIFC Legal Acts are complied with. Formal duties may include calling meetings, recording minutes of the meetings, keeping statutory record books, proper payment of dividend and interest payments, and proper drafting and execution of agreements, contracts, and resolutions.

OKED is the state code-classifier of the economic activity (industry) of the organization. It is selected and assigned during registration to each legal entity. The OKED classifier is a code that determines direction of a company or individual entrepreneur, with its statistical data collected. This data is important in terms of understanding the economic and industrial situation in the country. OKED can be obtained from the internet, for instance www.statinfo.kz

Private company is not obliged to issue shares (obligations), “share capital” is used to identify ownership of the company for each participant. For example a company decided to announce it’s share capital $100 and there are 100 shares, meaning that 1 share is for $1. Value of a share is share capital divided on amount of shares.

AIFC Companies Regulations and AIFC Companies Rules do not regulate the process of issuance of shares. There are no any specific procedures as well. Therefore, these processes are internal processes of a Company and may be defined and conducted in accordance with its Articles of Association or other internal document of a Company.

This activity falls under post-registration processes and you will need fill in application forms: 1. AIFC Notification of Change in the Registered Details; 2. Notification of actualization of information. Also you will have to enclose supporting documents: Copy of resolution approving the increase of authorised share capital; Amended Articles of Association (if applicable). Please note, that all application forms should be submitted within 14 days after the change. For more details please contact Participant Support at email [email protected]

You should adopt bespoke Articles of Association on the Registration stage. If you want to edit Standard Articles of Association after registration you will need fill in application forms: AIFC Notice of Amendment of Articles of Association. Be advised that the Articles of Association must not contain a provision that is inconsistent with AIFC Companies Regulations or AIFC Companies Rules.

Small: with an average annual number of employees of no more than 100 people and an average annual income of not more than 300,000 times the monthly calculation index (MCI) established in force on January 1 of the corresponding financial year (please refer to the paragraph 3 of article 24 of the Business Code of RoK). Medium: the average annual number of employees is from 101 to 250 people and (or) the average annual income is more than 300,000 times the MCI, but does not exceed 3,000,000 times the MCI inclusive year (please refer to the paragraph 5 of article 24 of the Business Code of RoK). Large: the average annual number of employees is more than 250 people and (or) average annual income over 3,000,000 times MCI.

Yes, all documents submitted to AFSA should be translated to English and notarized, or signed by Director/Authorised Person.

Registration as a VAT payer can be voluntary and mandatory. It is mandatory to register if you have reached the maximum turnover – 30,000 MCI (79,530,000 tenge in 2020).

Each shareholder/partner who is a body corporate is required to provide details of its beneficial owner who holds more than 25% of shares /ownership.

Yes. For example, Branch of….. doing business in the AIFC.

Founding members are applicants for the Incorporated Organisation’s incorporation; or appointed after its incorporation as a Founding Member by Special Resolution of the Founding Members; Founding members have unique rights governing and control of a company. Ordinary members do not have voting rights and cannot make decisions.

According to the AIFC regulations NPIO doesn’t have to have MLRO and adopt AML policies but NPIO should always have a chapter in the contract with such funds about purity of origin of funds (money).

A Representative Office must at all times have a Principal Representative who: (a) is resident in Kazakhstan; and (b) has satisfied the AFSA as to his/her fitness and propriety.

Ordinary shares and preference shares are distinguishing from each other based on their characteristics, benefits and rights that they offer to the holders of such shares. Ordinary Shares carry voting rights, Ordinary Shareholders have rights to receive dividends if the company makes profits, Ordinary shareholders receive their share of capital after the preference shareholders are paid. Preference shares represent an ownership stake in a company, and sometimes it called preferred stock. Preference Shares have a priority claim over the company’s assets and earnings. The shares are more senior than common stock but more junior relative to bonds in terms of claim on assets. Preference shareholders do not have voting rights on preference shares. However, they have rights to vote on the matters that directly affect their rights like a resolution of winding up of the company, or in the case of reduction of capital. Preference Shareholders enjoy priority first in the payment of profits and dividend. It promises the shareholders with a fixed dividend, both when the business is operating, and also in the event of a company entering into liquidation in the future. In the event of winding up of a company, preference shareholders are entitled to receive payment of capital after the claims of the company’s creditors have been paid, at the time of liquidation. In short, preference shareholders have preferential claims over dividend and repayment of capital as compared to equity shareholders. A Company may create different classes of Shares to the extent permitted by its Articles of Association.

Paid shares are shares issued for which no more money is required to be paid to the company by shareholders on the value of the shares. When a company issues shares upon incorporation or through an initial or secondary issuance, shareholders are required to pay a set amount for those shares. Once the company has received the full amount from shareholders, the shares become fully paid shares. Unpaid shares are those that have been issue but no money has been paid on them. This effects the liability of the shareholders. Those who haven’t paid for their shares can be called upon to cough-up if the company has financial difficulties. This leaves the shareholder liable to the company for the amount unpaid, particularly if the company becomes insolvent. Shareholders who have paid for their shares will have no further liability in the event of subsequent insolvency. Paid and unpaid types of shares applicable to all companies having share capital and shares.

Not less than U.S. $100,000 at any time.

Yes, PLC must have at least 1 Secretary

There are no requirements for the Secretary (body corporate of individual). It is required for a Public Company to have at least 1 Secretary (body corporate or individual). Please see 89. Secretary of the AIFC Companies Regulations.

No

The resolution is duly adopted by the Board of Directors or the shareholders and signed by them, depending on the type of resolution. Resolution of BoD is signed when there is at least one shareholder body corporate and Resolution of Shareholders is signed when shareholders are natural persons.

We have a separate application form ‘Details on classes of Shareholders/Share Capital’, which will be posted on AFSA website soon in Public Company subsection.

Investment Company is a prescribed type of Company formed and operates, for the sole purpose of conducting the business of a Fund. Prior to the incorporation of Company, written consent from AFSA is required.

Investment Company must either be an Open-Ended Investment Company or a Closed-Ended Investment Company.

Open-Ended Investment Company. In accordance with, AIFC COMPANIES RULES, SCHEDULE 4: INTERPRETATION (4.2), Open-Ended Investment Company means an Investment Company whose Articles of Association state that is an Open-Ended Investment Company with a variable share capital and otherwise comply with Part 6 (Investment Companies). Open ended Schemes offers unit for sale without specifying any duration for redemption. They Sell and repurchase schemes on a continuous basis. The main feature of such kind of scheme is Liquidity, Price is determined by NAV.

Closed-Ended Investment Company. In accordance with, AIFC COMPANIES RULES, SCHEDULE 4: INTERPRETATION (4.2), Closed-Ended Investment Company means an Investment Company that is not an Open-Ended Investment Company. These are the schemes in which redemption period is specified. Once the units are sold, then any transaction takes place in secondary market, i.e. stock exchange. Price is determined by forces of Marker, and can be sold at premium or discount.

A Fund (whether a Non-Exempt Fund or an Exempt Fund) may be a Specialist Fund.

The following types of Funds are Specialist Funds:

1) an Islamic Investment Fund;

2) a Private Equity Fund;

3) a Venture Capital Fund;

4) a Real Estate Investment Trust

It is mandatory to have MLRO for a Managing company that manages the Investment Company, in case if Managing company is Authorized Firm.

Private company

A Company shall only be permitted to be incorporated or registered, and operate, as a Restricted Scope Company if:

1) it is a Private Company; and

2) it is a subsidiary undertaking of another body corporate that prepares and publishes group accounts under the AIFC Companies Regulations or such other enactment as the Registrar may recognise for the purposes of this section; or

3) it is directly or indirectly wholly-owned by:

(i) one person; or

(ii) a group of persons who are members of the same family.

(iii) it is subsidiary undertaking of a body corporate that has been formed by a Decree of the President of the Republic of Kazakhstan

You can become an AIFC member by opening a branch/representative office (recognised company) or registering a new legal entity (private company).

Since Recognised GP is a partnership formed outside of the AIFC and recognized by the AFSA to conduct business in the AIFC jurisdiction, the number of partners should be as many as there were at the time of incorporation of partnership.

If we are talking about the GP in AIFC, must include 2 or more Persons called general partners.

Since Recognized GP is a partnership formed outside of the AIFC and recognized by the AFSA to conduct business in the AIFC jurisdiction, the applicant should demonstrate all ultimate beneficial owners. There is only requirement to show all ultimate beneficial owners. Please see Ultimate Beneficial Owners Guide.

In case if you use Trustee services.

All types of Partnership must have a partnership agreement.

On the AFSA website Registration section (Type of Participants subsection). Depending on the legal form they may differ. You can use template Resolution on SSP while registering.

All activities indicated in the Standard Articles of Association can be observed by downloading it from the website. If you want to make changes to the Standard Articles of Association than it would be Bespoke Articles of Association and is subject for revision by AFSA. Be advised that activities mentioned in the Standard Articles of Association should comply with information reflected in the application forms.

Yes

A General partner has the authority to act on behalf of the business without the knowledge or permission of the other partners. General Partner manages the business, has unlimited personal liability for debts and obligations.

As equity owners, shareholders are subject to capital gains (or losses) and/or dividend payments as residual claimants on a firm’s profits. Shareholders also enjoy certain rights such as voting at shareholder meetings to approve things like board of directors members, dividend distributions, or mergers.

A general partner is liable, jointly and severally with the other partners, for all debts and obligations of the partnership.

A company limited by shares, the liability of which is limited to the amount (if any) that remains unpaid on the Shares held by the Shareholder.

For more information, please see guide on organizational legal forms and please refer to relevant rules and regulations.

A limited partner is not liable for any of the partnership’s Liabilities beyond the amounts that they have already contributed or agreed to contribute.

A general partner is liable, jointly and severally with the other partners, for all debts and obligations of the partnership.

For more information, please see guide on organizational legal forms and please refer to relevant rules and regulations.

It includes information on number and value of shares.

Members of a partnership are natural persons as well as legal entities.

Only in GP.

Name of the legal entity and bank details. After providing these details, AFSA may issue an invoice for payment.

Residents of the Republic of Kazakhstan are obliged to pay in KZT according to the currency regulation of the National Bank. Non-residents may pay in USD.

No, only in KZT and USD.

Payment can be made at any bank and online on the portal.

After completing and sending the forms, AFSA will send you notification if there are some questions or mistakes in the application.