FAQ

- Group 1

- Corporate Matters

- Contractual Matters

- Rules and Regulations

- Fees and Invoices

- Legal Address

- Tax Matters

Answer1.

AIFC Participants must notify the Registrar regarding the changes in registered details. Follow the Guidance on Filing Obligations of AIFC Participants to the Registrar of Companies.

AIFC participants may open a bank account in any bank. The requirements are defined by the selected bank.

EDS can be obtained online at https://egov.kz/cms/en/services/pass_onlineecp or by visiting a community service centre (ЦОН) near you.

AIFC Participants must notify only the Registrar by filing the applications. Changes in DoJ are handled by the Office of the Registrar.

AIFC Participants are obliged to complete a specified number of filings to the Registrar of Companies on an annual basis depending on the level of turnover. The following are the ongoing filing obligations:

• Filing of annual accounts

• Filing of annual return

• Filing of annual confirmation statement

Follow the Guidance on Filing Obligations of AIFC Participants to the Registrar of Companies.

No, all supporting documents must be in English language or accompanied by an appropriate translation certified to the satisfaction of the Registrar of Companies.

Constitutional Statute of the RoK on the AIFC, Article 15.Language of the AIFC.

Please find the list of Ancillary Service Providers (with their contacts) on the https://digitalresident.kz – Ancillary Service Providers.

Yes, in this case, the participant sends all necessary documents at the same time, and the total price of all procedures will be 50 USD.

No, the original versions must be provided to the Office of the Registrar. (Because of the coronavirus pandemic the Office of the Registrar accept scan copies by now)

An administrative inquiry includes the:

1) Request for extract of shareholders’ registry

2) Request for extract of directors’ registry

3) Request for extract of Ultimate Beneficial Owners registry

4) Request for extract from Public Register

Approximately 5 business days. For more information on the process of making post-registration application, refer to Guidance on Post-registration applications to the Office of the Registrar of Companies (https://afsa.aifc.kz/post-registration/ (Afsa.aifc.kz – registration – post registration)

Director/CEO or authorised signatory.

Chief Executive Officer must be a natural person who has an Individual Identification Number (IIN).

AIFC Participants have to send share pledge agreement to the Security Registrar ([email protected]) and make payment of fees in accordance with AIFC Security Rules (Schedule 1)

No, AFSA does not monitor the participant’s contract. It is only required to register Share Pledge Agreement.

No, the Contracts with third parties (clients, suppliers, partners) can be concluded in any language, but they must be provided in English or certified and translated into English in case of litigation in AIFC Court.

No, the employee contracts are operational documents and mustn’t be registered in AFSA. It is recommended to register employee contracts in The Single Accounting System for Employment Agreements (ЕСУТД). Employee Contracts are drawn up in accordance with AIFC Employment Rules for all AIFC Participants. All other Civil Contracts must be compiled in accordance with AIFC Contract Regulations.

No, all supporting documents must be in the English language or accompanied by an appropriate translation certified to the satisfaction of the Registrar of Companies.

Constitutional Statute of the RoK on the AIFC, Article 15.Language of the AIFC.

You need to contact [email protected].

No, participants must receive information about changes to the AIFC Rules and Regulations by themselves on the website: afsa.aifc.kz (legal framework – public consultations – Afsa)

Website: afsa.aifc.kz (legal framework – public consultations – Afsa)

No. If AIFC Participant is engaged in regulated activities, it must contact its Relationship Manager (or send an email to [email protected]) for making necessary arrangements in relation to the Post-registration application and obtaining the required approval (if necessary).

An AIFC Participant may request an Extract of information from AFSA, who in turn will issue a certificate upon payment of 20 USD for the procedure.

Yes, other legal entities may pay the invoice for a participant, in this case, there must be indicated BIN (or bank requisites for non-residents) of the payer in the request for an invoice for the post-registration procedure.

50USD

Yes. A participant must pay an appropriate fee regardless of whether MoJ is notified. All prescribed fees payable to AFSA are set out in AIFC Fees Rules, where post-registration fees are listed in Schedule 5-1.

An administrative inquiry fee is 20 USD.

Yes. If a natural person is a resident of RoK, then IIN and a copy of ID (both sides) must be provided. If a natural person is a non-resident of RoK, then a passport copy must be provided.

Yes. If a body corporate is a resident of RoK (AIFC Participants are residents of RK), then BIN must be provided. If a body corporate is a non-resident of RoK, then bank requisites must be provided.

If a payer (natural person/body corporate) is a resident of RK (AIFC Participants are residents of RK), then the invoice must be paid in KZT only, non-Resident can pay in USD.

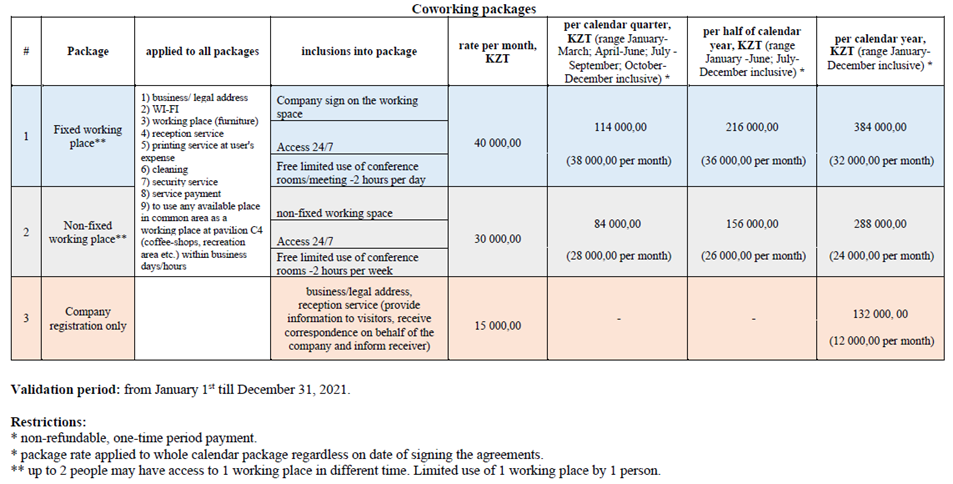

The concept of a coworking zone has been established as a response to market demand and helps to overcome the operational challenges of our valuable participants. AIFC offers a coworking zone as a legal address.

Upon registration process (once a company obtains BIN), a company has to sign a sublease agreement, which is put in place for contract terms and conditions between the “Lessor” (AIFC Authority JSC) and the “Party” (a prospect). A process of obtaining a legal address is issued in turn, as follows:

- A company completes a form for allocation at a coworking zone and sends it along with a certificate of incorporation to us, the ABC Participant Support Department;

- ABC Participant Support Department signs it and passes it over to AIFC Property Department;

- AIFC Property Department sends a commercial proposal to a representative of a company;

- AIFC Property Department sends a signed and approved sublease agreement to a company;

- Once both sides sign a sublease agreement, a company keeps one copy for their own relevant purposes.

It is the sole responsibility of a company to have a registered office within the AIFC territory upon the expiration of a sublease agreement.

AIFC Companies Regulations, Section 24. Registered office.

A legal address is valid for the duration of a sublease agreement and a company shall be solely responsible for allocation within the AIFC territory upon expiration of a sublease agreement and a legal address.

AIFC Companies Regulations, Section 24(1). Registered Address

Yes. If a company changes its office location, then it must undergo a post-registration procedure: change of registered address. A company may change the address of its registered office by giving notice to the Registrar. The change takes effect upon the notice being registered by the Registrar. There is an associated fee of 50 USD.

AIFC Companies Regulations, Section 24 (3-1).Registered office.

Fees Rules, Schedule 5-1: Administrative service fees payable to the Registrar of companies.

7000 tg for 1 sq.m.

You may contact AIFC Property ([email protected]) to make a sight inspection of coworking zones and offices.

AIFC Participants must file tax reports in accordance with Article 6 of the Constitutional law of the Republic of Kazakhstan on AIFC. Tax reports must be submitted to the Department of State Revenue of Essil district.

Using an electronic digital signature (ЭЦП) you can enter to Taxpayer’s webroom at https://kgd.gov.kz/

The concept of coworking does not require a full-time presence of a company and therefore passing tax inspection, which is also convenient for VAT payers. The Tax Code RoK, Article 558: Tax Inspection, subparagraph 4, in the event of a tax inspection resulting in the actual absence of taxpayers (tax agents) in places of their location specified in the registration details, the Tax Service Authority shall forward to such taxpayer a notice for the confirmation of the location of the taxpayer (tax agent).

Authorisation FAQs

The Centre can accommodate a broad range of activities outside the ones that are described as Regulated, Ancillary or Market Activities. Currently, there is a range of non-financial services firms and holding companies which have been registered by the AFSA as Centre Participants.

Any company intending to carry on one or more Regulated Activity, Ancillary Service or Market Activity in or from the AIFC needs to seek authorisation to become an AIFC Participant. The full list of Regulated Activities, Market Activities and Ancillary Services authorised by the AFSA is included in the Schedules 1, 2 and 4 of AIFC General Rules (GEN). It is important to note that in accordance with Section 24 of the AIFC Financial Services Framework Regulations, a Centre Participant must not carry on a Regulated Activity, Market Activity or Ancillary Service unless it is licensed to do so by the AFSA. For more information, please, go to www.aifc.kz > Legal Framework > Legal Framework > AIFC Financial Services Framework > General Rules / Financial Services Framework Regulations

The Regulated Activities are financial services that need authorisation from the AFSA. These include brokers and dealers, investment and fund management, banking, fund administration, providing and arranging custody, islamic finance, and other activities including operating a representative office. AFSA also authorises professional services that support the financial services industry i.e. Ancillary Services. There is a list of all the activities with descriptions that are authorised by the AFSA in the AIFC GEN Rules Schedules 1 and 2 (please, go to www.aifc.kz > Legal Framework > Legal Framework > AIFC Financial Services Framework > General Rules).

The AIFC laws and regulations do not allow for Sole Traders as a legal form of company. Therefore, an individual cannot be authorized in his/her own right to carry on a Regulated Activity, an Ancillary Service or a Market Activity in or from the AIFC. He/she may, however, carry on these services/activities as an Approved Individual or Designated Individual of an AIFC Participant.

An Approved Individual is an individual who is approved by the AFSA to carry out a Controlled Function. Approved individuals are employees of Authorised Persons who attract regulatory attention as they occupy the most critical roles in an Authorised Person, which are referred to as “Controlled Functions”. Their appointment requires the approval of the AFSA.

This consists of the following functions – Senior Executive Officer; Director; Finance Officer and Compliance Officer. These individuals has to know and meet our regulatory requirements, as well as understand how we apply them. The functions specified in GEN 2.2.2 to 2.2.5 are Controlled Functions (please, go to www.afsa.kz > Legal Framework > Legal Framework > AIFC Financial Services Framework > General Rules).

A ‘Designated Individual’ is an individual appointed by the firm to perform a ‘Designated Function’ on behalf of an Authorised firm. Designated Individuals occupy less critical roles, referred to as “Designated Functions”. They do not require AFSA approval, but may only be appointed by a firm after it has applied a fit and proper test. AFSA must be notified of the appointment.

A Designated Function is any of the functions specified in GEN 2.3. This consists of the following functions – Senior Manager; Responsible Officer; Money Laundering Reporting Officer; Risk Manager and Internal Audit Manager.

Generally, the Money Laundering Reporting Officer (MLRO) function must be performed by an individual ordinarily resident in the Republic of Kazakhstan. While there is no strict requirement for the Senior Executive Officer to be resident in Kazakhstan, the expectation is that the individual must spend an appropriate amount of his/her time in the Republic of Kazakhstan having due regard to the responsibilities that the Senior Executive Officer entails.

If you plan to carry on financial services activities or non-financial services activities, in or from the AIFC, you will need to register with the AFSA and incorporate your entity.

All entities intending to carry on one or more Regulated Activity, Ancillary Service or Market Activity, in or from the AIFC, need to seek authorisation and registration/incorporation to become an AIFC Participant. Entities intending to carry on non-financial services activities, in or from the AIFC, will only need to register and incorporate.

No. This can be done post-authorisation. The registration/incorporation is a condition of every authorisation.

No, registration prior to Authorisation is not permitted due to several reasons: 1) As a regulator, we want to make sure that an applicant firm is fully aware of all the requirements, Rules and Regulations it has to comply with; 2) We want to make sure that as a regulator, there is no financial service or ancillary service conducted without our supervision.

A broker or dealer, located in a jurisdiction other than the AIFC may apply to AFSA for an order declaring it be a Recognised Non-AIFC Member, while a firm which operates an investment exchange or clearing house from a place of business in a jurisdiction other than the AIFC may apply to the AFSA for an order declaring it to be a Recognised Non-AIFC Market Institution. For more information on RNAMs, please, go to www.afsa.kz > Media Centre > News > AFSA Note on Recognized Non-AIFC Members.

No, they are not authorised AIFC firms. RNAMs and RNAMIs are based outside the AIFC but receive a Recognition Order based on the satisfaction of certain requirements, which includes an equivalent regulatory environment. For example, Qualified market participants, such as brokers and dealers, may apply for recognition status and get access to the Astana International Exchange (AIX).

While a Recognised Company is a branch of a Foreign Company/Partnership located outside of the AIFC jurisdiction that has been registered (and authorised, if applicable) by the AFSA, and is considered to be an AIFC Participant, a Recognised Non-AIFC Member is a broker or dealer from a recognised jurisdiction by AFSA with a relevant licence granted by recognised financial services regulator, who obtains permission from the AFSA to get access to the AIX directly, without establishing legal presence and obtaining relevant authorisation, but is not considered an AIFC Participant.

Operating a Representative Office is a regulated activity authorised by the AFSA, which essentially means marketing from an establishment in the AIFC, of one or more financial services or investments which are offered in a jurisdiction other than the AIFC. The Financial Service of Operating a Representative Office is defined in the AIFC Representative Office Rules (REP) 2.3 (2). It means the marketing by a Person of one or more financial services or financial products which are offered in a jurisdiction other than the AIFC. REP Rules 2.3 defines “marketing” as: (a) providing information on one or more financial products or financial services; (b) engaging in promotions in relation to (a); or (c) making introductions or referrals in connection with the offer of financial services or financial products. Under the AIFC Representative Offices (REP) Rule 2.3 (3) (a), a Representative Office must not represent anyone other than itself or a member of its Group. The term “Group” is defined in the AIFC Glossary. For more information, please, go to www.aifc.kz > Legal Framework > Legal Framework > AIFC Financial Services Framework > Representative Office.

We strongly suggest that firms, in the first instance, engage with the AIFC Business Connect Team. They will help you understand the value proposition of the AIFC to assist your evaluation of whether a presence here will make business sense for your firm. Please contact the Business Connect team by emailing [email protected].

AFSA is an independent regulator and therefore cannot give advice on the same application it is assessing for authorisation. While members of the AFSA Authorisation team might be able to assist applicants regarding the application process and AFSA’s requirements relating to the application, the AIFC’s Business Connect can provide more hands-on assistance. Applicants are therefore urged to speak to a Business Development Officer within Business Connect prior to submitting an application. Alternatively, there are a number of AFSA authorised Consultants listed on the AFSA’s Public Register that can provide a service. For more information, please, go to www.afsa.kz > Public Register.

1. We will acknowledge its receipt within 3-5 business days; 2. We will forward an initial review letter within approximately 10 business days. Dialogue between the AFSA and the applicant will continue as required; 3. We aim to complete a final review and recommendation within 21 days for Ancillary Service Providers and 3 months for Authorised Firms. A successful application will then result in the AFSA issuing the applicant an “in-principle” letter. This document will allow you to complete any other outstanding matters. For example, the incorporation procedure with the Registrar of Companies or opening a bank account in favour of the new entity; 4. The in-principle letter will generally be valid for 1-3 month. Any conditions in the in-principle letter, such as incorporation, operational premises, capitalisation of the firm or any other outstanding matters, must be completed within this time frame; and 5. We will only issue you with your AFSA licence when you can demonstrate that you have fulfilled all of the conditions set out in the in-principle letter. The timeline set out above is indicative only. The time taken to process your application will depend on its scale and complexity, as well as the timely submission of information by the applicant, and his/her response to any requests for further clarification. We point out that the need to make the correct regulatory decision will always take precedence over meeting target timescales.

We endeavour to process all licence applications promptly, however, the actual process times depend on the complexity of the applicant’s proposed operations, the timeliness of responses and the quality of the application itself. Average application processing time for applications related to regulated activities and market activities, from the time the AFSA receives a materially complete application, is around two to three months. This does not include any time the AFSA is awaiting information or a response from the applicant. On average materially complete applications for ancillary services take a month.

An application that fully satisfies the threshold conditions for authorisation and answers all questions asked. Note that the application process is interactive, and may involve meetings, correspondence, review of policies and procedures from the applicant or third parties and sometimes even an onsite inspection.

The authorisation application fees vary depending on the nature and extent of the Regulated Activity, Market Activity or Ancillary Service. Please refer to Schedule 1, 2, 3 and 4 of the AIFC Fees Rules (Main > Legal Framework > Financial Services Legislation > Fees Rules) to find details on fees for applying for a Licence to carry on Regulated, Market Activities, Ancillary Services and for applications for Recognised Non-AIFC Market Institution and Recognised Non-AIFC Member status. You can download the authorisation application form and application forms for Approved Individuals and Designated Individuals from AFSA’s website at www.afsa.kz > Firms > Authorisation > Forms. The forms include guidance notes which provide information on completing the forms and should be read in conjunction with the relevant legislation.

The Authorisation authorises an AIFC Participant to carry on activities in or from the AIFC. If an AIFC Participant wishes to establish an additional office outside the AIFC, it must comply with the relevant legislation in the jurisdiction where it proposes to establish and comply with any restrictions or requirements that other jurisdictions may impose. We urge AIFC Participants to take independent legal advice as to whether they would require an additional license or authorisation from regulatory authorities of the Republic of Kazakhstan, such as the Agency for Regulation and Development of Financial Markets. Please also read the FAQ section related to AIFC Participants (please, go to www.aifc.kz > FAQ > AIFC Participation).

Carrying on activities in or from the AIFC refers to activities carried out in the AIFC between two AIFC Participants or between an AIFC Participant and another party located outside the AIFC, either in the Republic of Kazakhstan or outside of the Republic of Kazakhstan.

The AFSA is a member of various international organisations and standard-setting bodies. It applies best international standards and is a signatory to many Memoranda of Understanding (MoUs), IOSCO and IAIS Multilateral Memorandums of Understanding (MMoU) and bilateral agreements with such bodies and regulators around the world. These MoUs, MMoUs and bilateral agreements place international obligations of cooperation on AFSA with these bodies and regulators in other jurisdictions.

The AFSA maintains and publishes a Public Register of current and past grants of withdrawals and suspensions of licences and authorisations of all Registered Entities, Authorised Firms, Authorised Market Institutions (AMI), Ancillary Service Providers, Recognised Non-AIFC Members, Special Purpose Companies and FinTech Lab Participants. The public register is published on the AFSA website www.afsa.kz > Public Register > Firms.